Chinese people are buying more smart speakers but they aren't using them

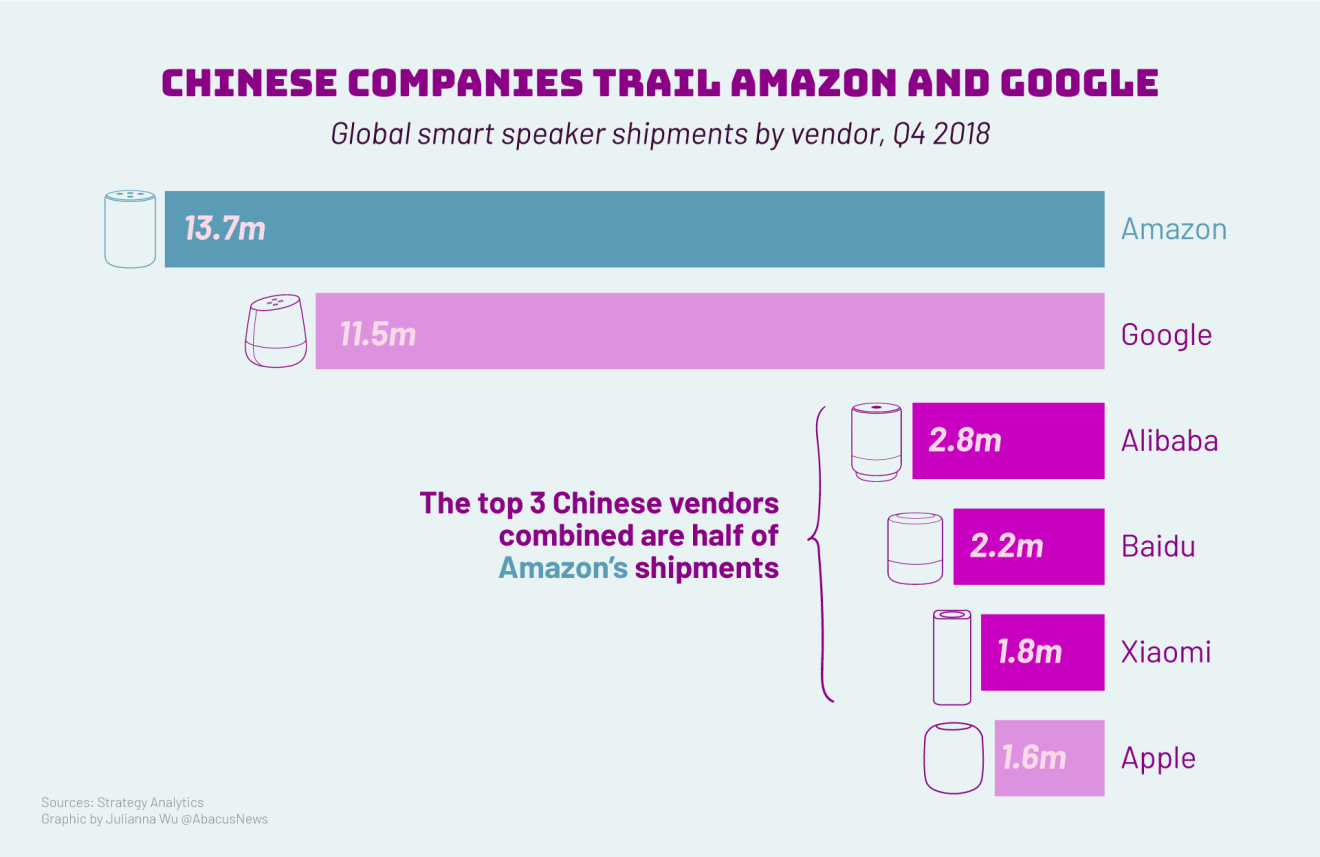

Alibaba, Baidu and Xiaomi trail only Amazon and Google in shipments, but few seem to be actually using the devices

The predictions weren’t wrong: Extremely rapid sales growth meant there were plenty of smart speakers reaching Chinese homes in 2018. The problem is that it seems few people are actually using them.

Ivy Sun was very excited when her parents got a Tmall smart speaker from friends last year. “I went back to Shanghai with high expectations to find out how ‘smart’ it can be,” she said.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba -- which also owns Tmall.)

Weeks later, the family lost interest, and now the smart speaker is a mere music player.

They know it can control some home appliances or even allow them to shop online with their voice. But Sun said “we don’t have any smart home appliances and it sometimes took forever to react”.

But analyst Mengmeng Zhang from Counterpoint says high shipments doesn’t automatically equal popularity among consumers, especially given how cheap smart speakers are in China.

“During the Singles’ Day sales in 2017, Alibaba gave big discounts on their smart speakers to drive sales,” said Zhang. Alibaba’s Genius X1 cost just US$15 (99 yuan), almost 80% less than the original price.

Singles’ Day, the shopping event that makes Black Friday look like a yard sale

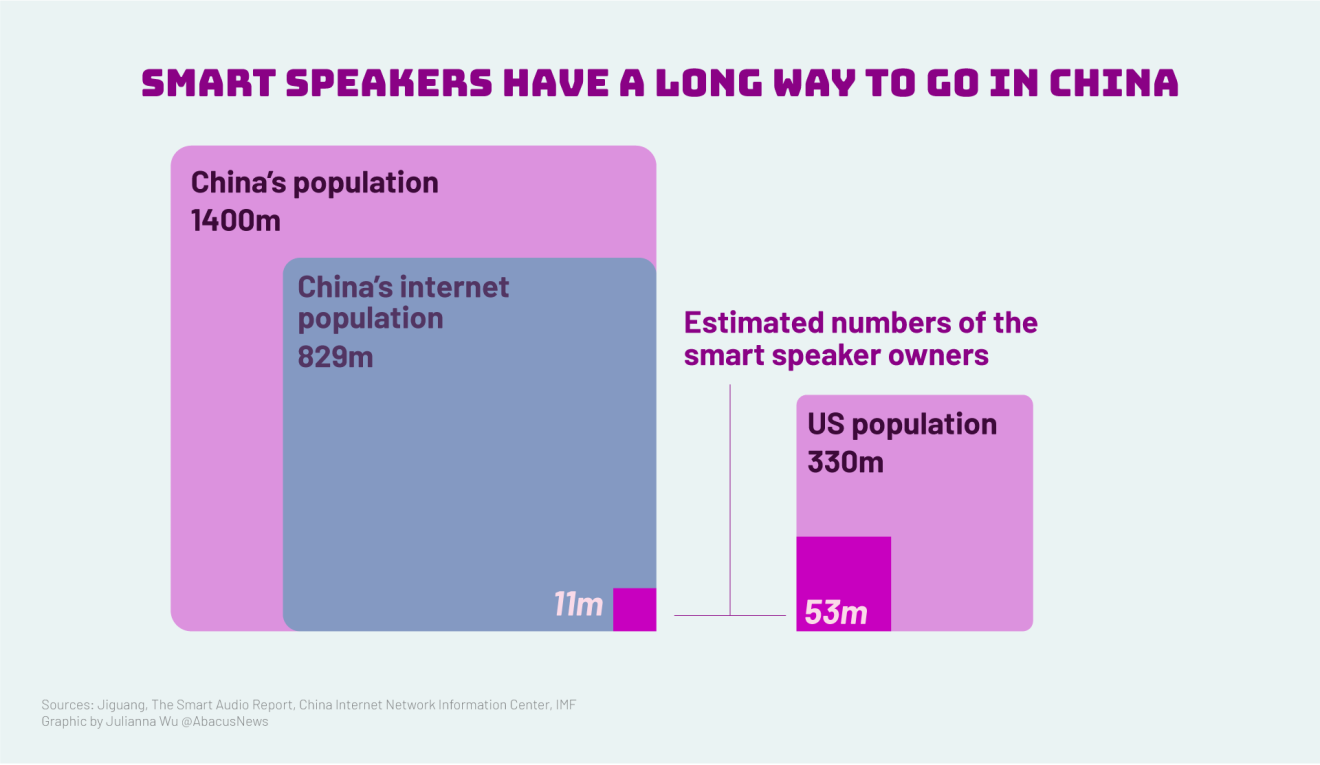

There were 829 million internet users in China by the end of 2018, but only around 11 million of them had smart speaker apps on their phones. That’s just 1.3%.

So why are people in China buying smart speakers but not using them? It might be down to an immature ecosystem and poor device performance.

Experts interviewed by Abacus believe that time is needed for developers behind smart speakers to build up a database of user habits and voice commands.

“This technology never brought up massive public attention in China until the end of 2017,” said Sophie Pan, an analyst from IDC. “It’s not very fair to compare Chinese market to the US, whose customers have been exposed to this technology years earlier.”

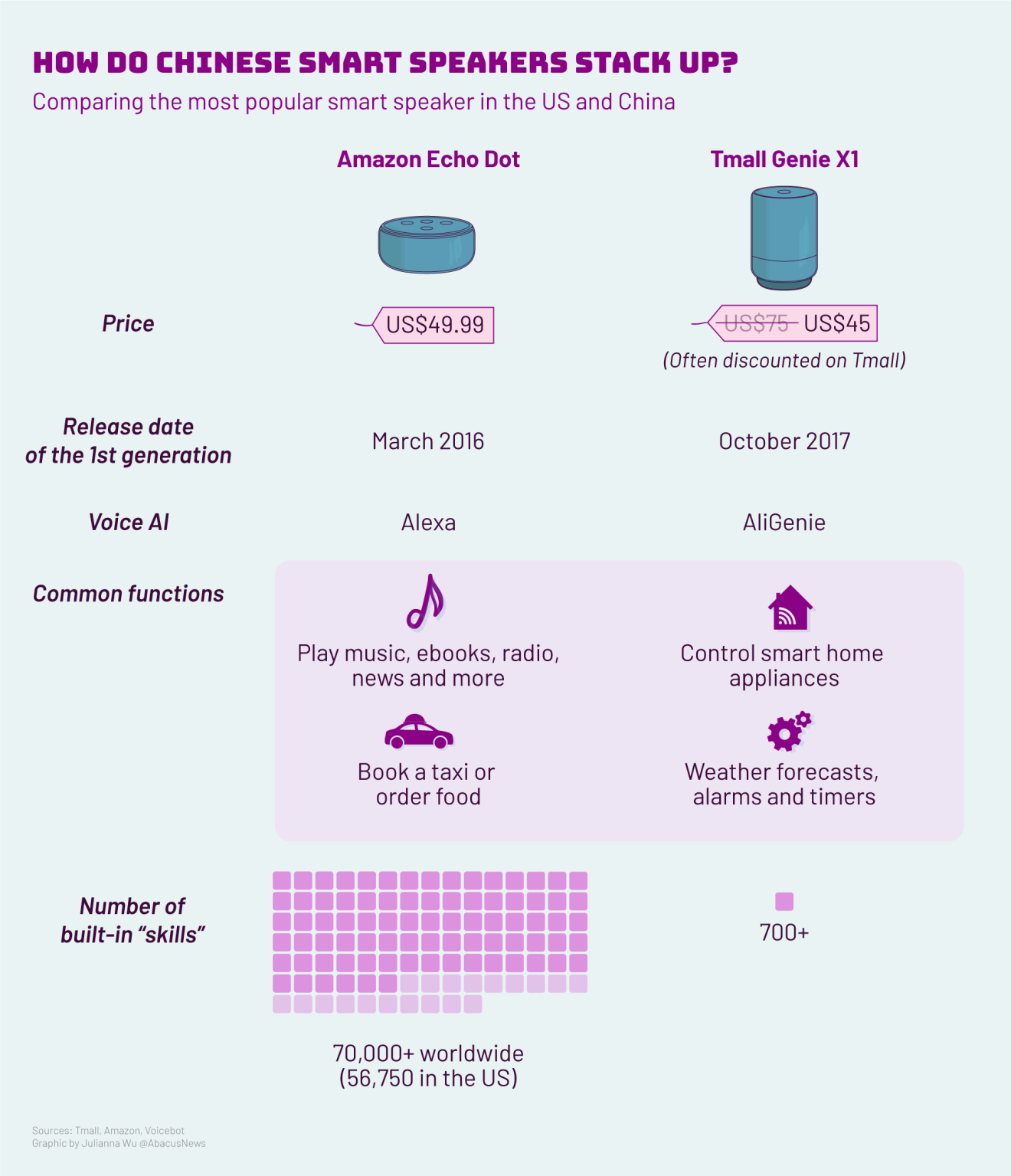

Take the top selling smart speakers, for example. Amazon’s Echo Dot comes from a line of smart speakers introduced all the way back in 2015, while Alibaba’s Tmall Genie didn’t emerge until 2017.

Put simply, Amazon’s smart speakers have been available twice as long as Alibaba’s -- allowing it to mature and add more third-party “skills”, add-ons that allow the Echo to do things like call an Uber. The Tmall Genie, in comparison, has less than a thousand.

The lack of functionality could be contributing to a lack of users. But if there aren’t enough users, then there’s little reason for developers to build skills for the platform. It’s a vicious cycle. Can China’s smart speakers break out of it?

For more insights into China tech, sign up for our tech newsletters, subscribe to our Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.